FHA Student Loan Calculation Update: Good News for Homebuyers!

Good news!

HUD (U.S. Dept of Housing and Development) announced their change to the student loan payment calculation. This adjustment changes the monthly payment amount considered in a homebuyer’s DTI (debt to income ratio).

In other words, this change makes it easier for you to qualify to buy a house because your debt-to-income ratio will likely be lower than it was with the old calculation.

The change drastically helps homebuyers meet minimum eligibility requirements for an FHA-insured mortgage.

If you are on an income-based repayment plan, the lender can now use monthly payment amount listed on your credit report as long as it is not $0. Prior to this change, FHA used of 1% of your total student loan balance.

If you are in deferment, lenders are can now use 0.5% of your student loan balance. Prior to this change, FHA used 2% of your total student loan balance.

Here’s an example of why this change matters:

Little known fact: pre-approvals are based on a maximum monthly mortgage payment, NOT the purchase price of a home. Your pre-approval is based on your buying power!

Definition of buying power : the amount of money that a person has available to spend.

Your pre-approval or buying power is based on $2,000 maximum spending each month, not on $250,000 purchase price of the home.

Consider it from the perspective that the monthly mortgage payment is made up of several expenditures:

principal & interest payment

Homeowners Insurance

Property Taxes

mortgage insurance (required on FHA loans)

flood insurance (if required)

For the sake of this brevity in this article, all of those put together make up your monthly mortgage payment.

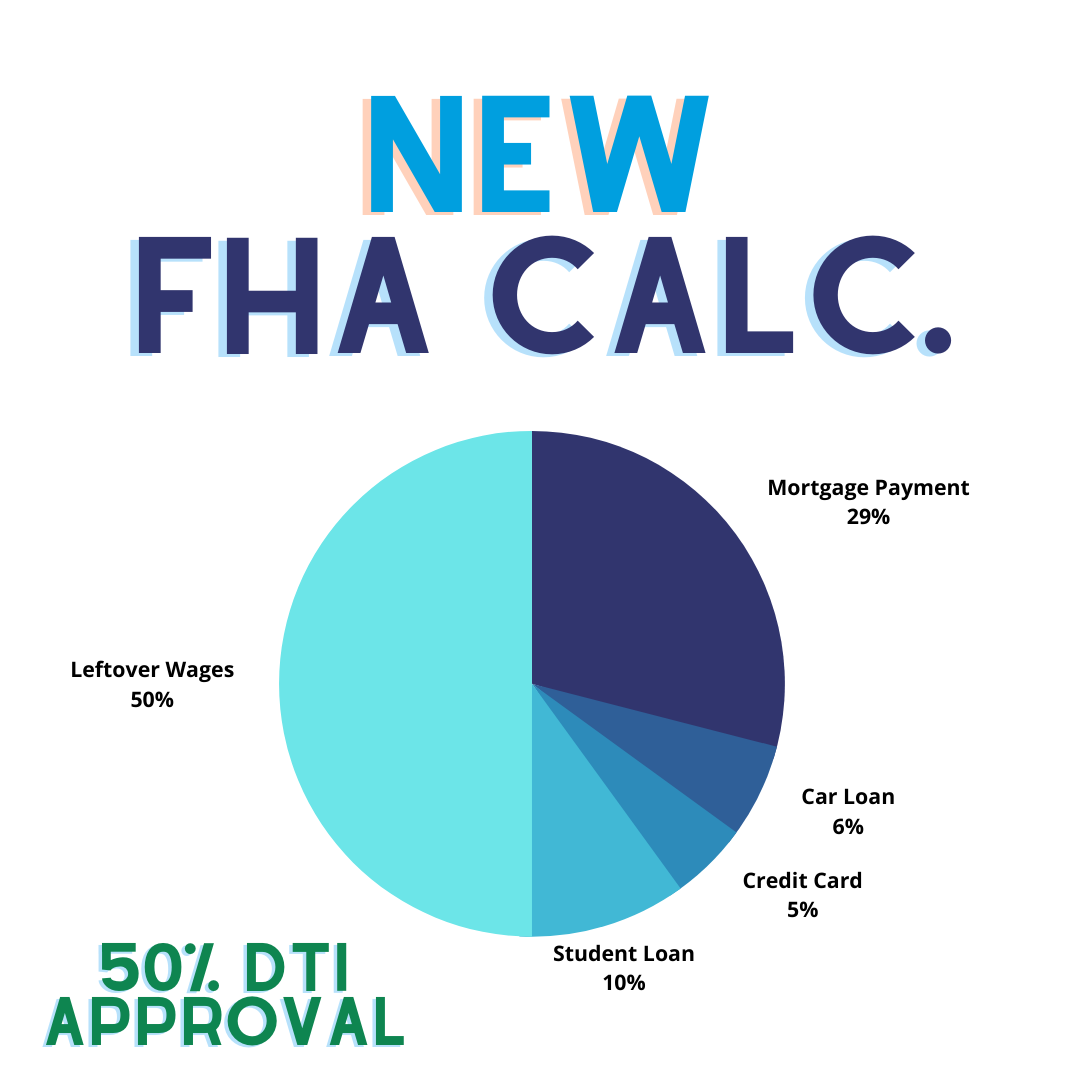

To calculate your debt-to-income ratio, you add up all your monthly debt payments and divide them by your gross monthly income. So if your student loan payment calculation is cut in half, you can certainly afford more house!

Here’s a scenario:

Let’s suppose you have a credit card, car note, and student loans based on the diagram below. With the old calculation usually equating to double the new calculation, there’s much more opportunity for homebuyers with student loans.

If you have any questions about your student loans and how it effects your ability to qualify for a mortgage, please give us a call at 225-900-7447. We can’t wait to work with you!