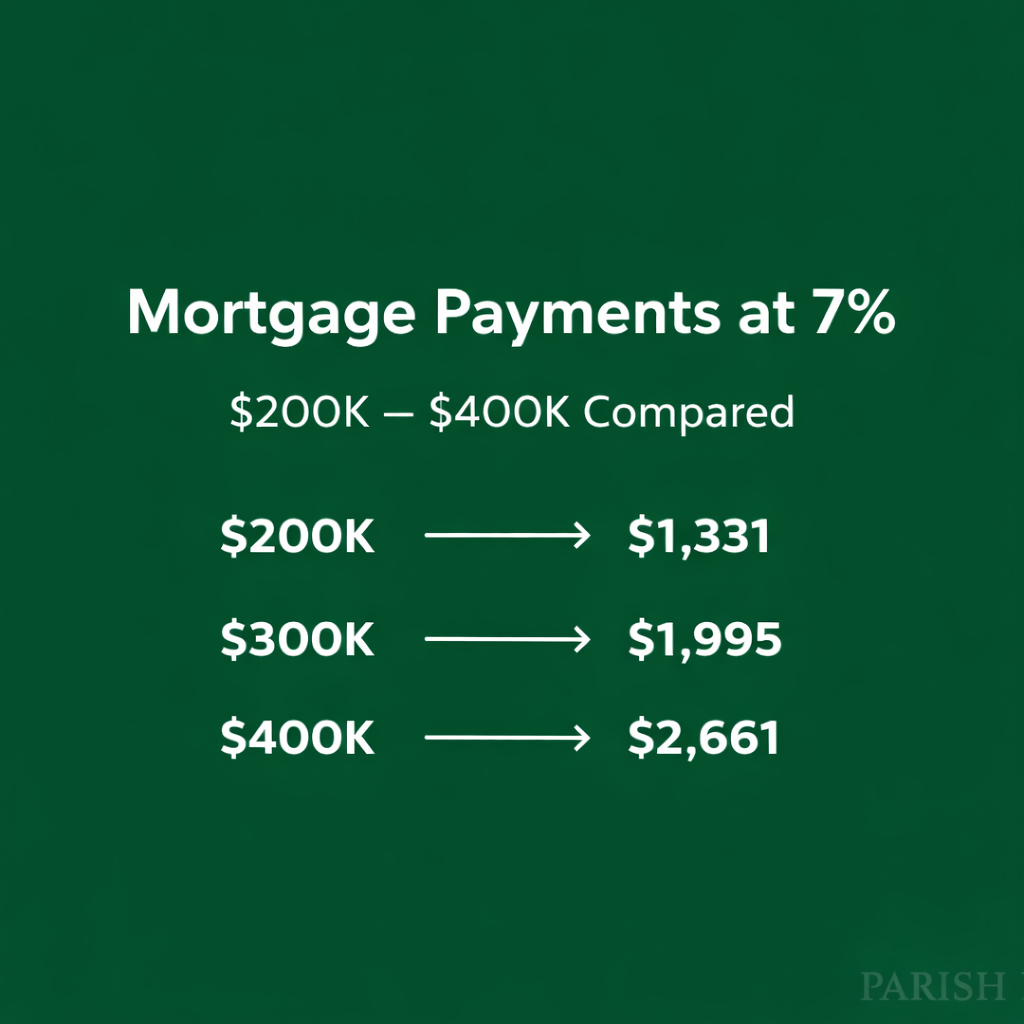

How Louisiana Mortgage Payment Change at 7%: $200k to $400k Compared

Louisiana mortgage payment comparison at 7 percent for $200,000 to $400,000 loans

If I pay $5,000 more for the house of my dreams, how much will it increase my Monthly Payment?

Wondering what that extra $5,000 on your home’s price tag really costs per month? Use our interactive calculator to see your payment increase and make smart home-buying decisions.

Simple Guide for Homebuyers with Low Credit History

Buying a home with low credit is possible—if you know where to look. Learn how Parish Lending helps buyers with low scores get approved.

How Much Can I Afford?

Determine your mortgage affordability in Louisiana with this comprehensive guide, featuring insights from top housing authorities.

Making an Offer on a Home

Ready to buy a home in Louisiana? Learn how to craft a smart, competitive offer with guidance from the most trusted home loan programs.